how to report coinbase on taxes

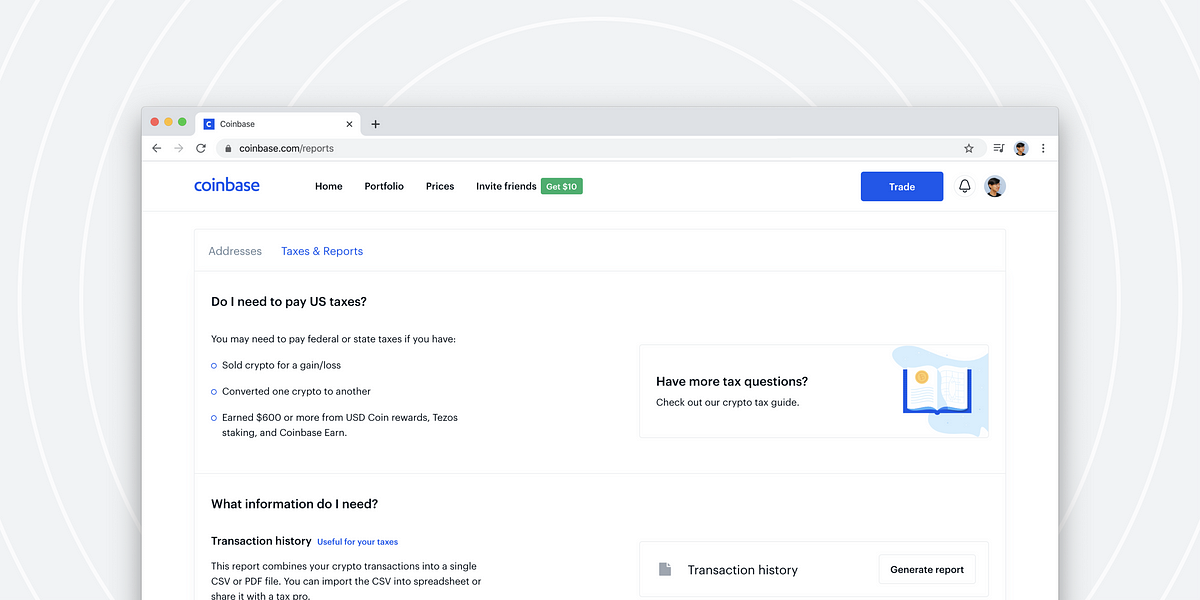

Go to the Reports page by clicking the user icon in the top header and click Reports. However if the 50 was paid to you for some service that you performed it would be.

How The Irs Knows You Owe Crypto Taxes Tax Refund Get Cash Now Irs

How To Report Coinbase On Taxes.

. Simply follow the steps below to get your public address and your tax forms will be ready shortly. Selling your crypto for cash. The Coinbase Transaction History CSV file contains a record of all of your buys sells transfers.

Coinbase will report your transactions to the IRS before the start of tax season. In most tax jurisdictions the following transactions are treated as taxable events. Any realized gains resulting from exchanging crypto assets into.

Treat them as capital gains. Import txf file into Turbotax Desktop. Its the form used for crypto exchanges because it doesnt simply detail profits it lists the transactions and the.

Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season. Crypto Trading Tax Rules Taxing and legalizing BTC and crypto trading is a complex issue with every state having its own set of rules. Does Coinbase report to the IRS.

Place it in other income if the software ask if this was earned income the answer is. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets. Click the Generate report button.

Coinbase does offer reports to help you accurately report your taxes. Form 1099 reports your third-party transactions to the IRS. Coinbase tax information and suggestions.

Leave the default settings All time All assets All transactions or. Here is what the 1099-MISC looks like just so. Its probably below their limit to send a 1099-misc or similar 1099.

You can also upload a CSVExcel file instead of connecting your account with the. If youd rather avoid the Coinbase tax report API. Keep in mind that the IRS and Coinbase are currently in a disagreement about whether or not Coinbase needs to turn over all major data about its users.

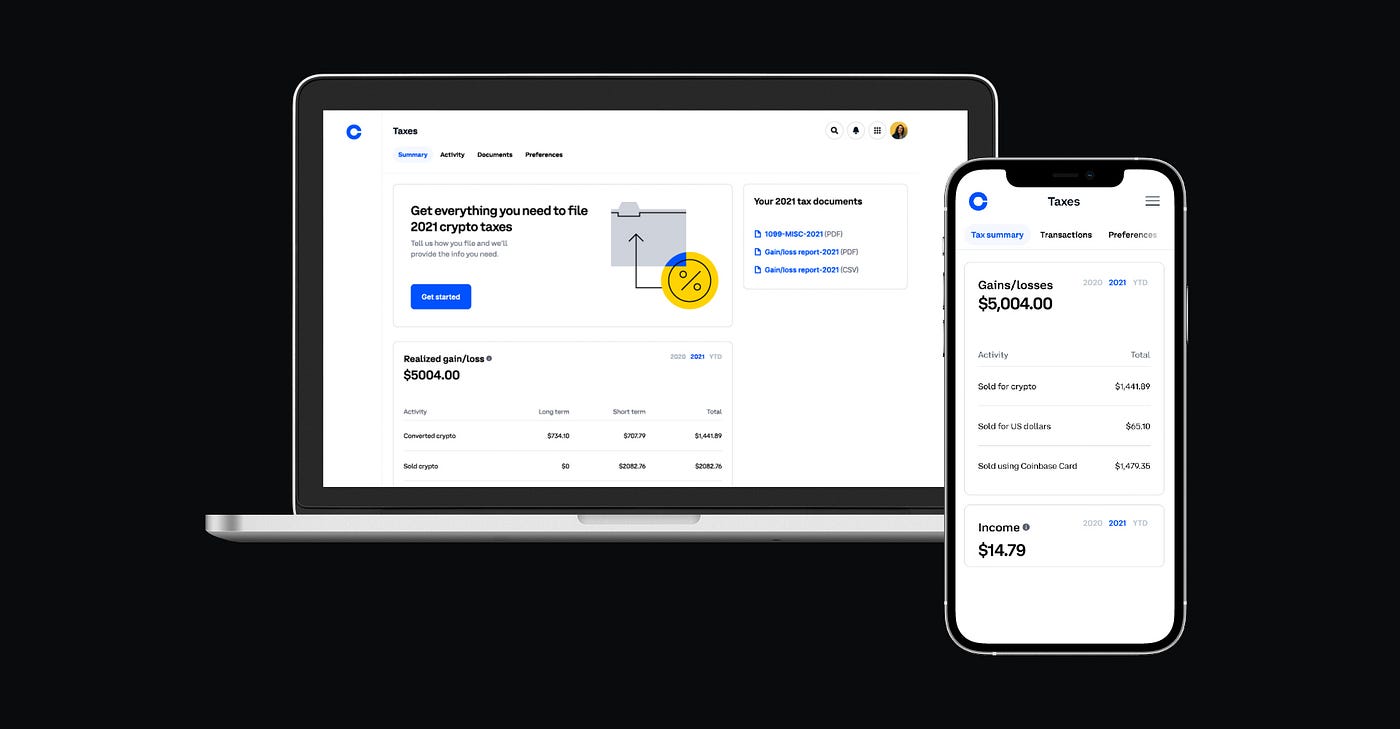

The Coinbase tax report API is read-only so you dont need to worry about another app having access to your Coinbase account. In a recurring pattern as published by Reuters investigation report Binance has helped launder money originating from scams hacks. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost.

Yes but for those accounts that are eligible as per IRS Forms 1099-MISC. How to report cryptocurrency on your tax return. Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the IRS if you.

You will receive a 1099 tax form from Coinbase if you pay US taxes are a. If Coinbase has sent you a tax form such as a 1099-MISC that form has also been sent to the IRS. Crypto can be taxed in two ways.

The simplest answer is. Coinbase will only send you Form 1099-MISC if. Gather a list of all your exchanges and transactions including any 1099 forms exchanges sent you Step 2.

The only form they still issue is 1099-MISC probably to streamline their tax services. Cryptocurrency sold exchanged spent or converted is treated as sale of property. File Import From Accounting Software Other Financial Software TXF file Continue Choose a File to Import Import now.

Coinbase will also provide a copy of the form to its users aka you and as a taxpayer it is your duty to report all taxable activities while reporting taxes.

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Understanding Crypto Taxes Coinbase

Blockchain Monitoring Supplier Parsiq Integrates With Crypto Custodian Hex Belief En 2021 Blockchain Ecosysteme 100 Millions

Did You Trade Crypto In 2018 If So You May Owe Taxes If You Re A Us Taxpayer Here Are Steps You May Have To Take What Forms You Ll Tax Guide

Now Coinbase Can Help You Calculate Your Cryptocurrency Taxes In Three Simple Steps Bitrazzi

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

7 Best Bitcoin Lending Sites To Earn Bitcoin Interest Thinkmaverick Bitcoin Investment Quotes Lending Site

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Crypto News Bitcoin Regulation Coinbase Cryptocurrency Cryptocurrency News Bitcoin Mining Software

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

The 2020 Guide To Cryptocurrency Taxes Cryptotrader Tax Tax Guide Best Crypto Tax Software

Crypto Exchange Coinbase Set To Expand Operations In India In 2021 Securities And Exchange Commission Cryptocurrency News Blockchain Technology

March 2020 Report Into Cryptocurrency Exchanges From Cryptocompare Bitmex Blog Cryptocurrency Best Cryptocurrency Exchange Best Cryptocurrency

How Do Crypto Taxes Work In The Us Learn What Forms You Ll Need And How Crypto Might Affect Your Taxes Tax Guide Bitcoin Capital Assets

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Does Coinbase Report To The Irs Tokentax Family Office Ireland Cryptocurrency

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group